ILB Methods

A new concept aims to present models of finance and quantitative economy

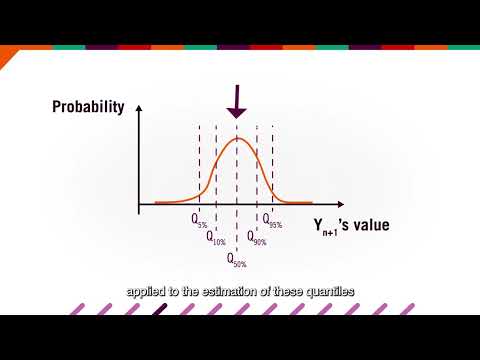

These models are used by scientific researchers and sectors such as insurance, agriculture or energy. Given the complexity of the phenomena, these models have become increasingly elaborate and make use of highly advanced technical concepts.

ILB Methods aims to demystify these models using a pedagogical approach. Each issue of the ILB Methods series presents a topic accompanied by a short video and a ten-page summary with links to specific references for readers who wish to explore the subject further.

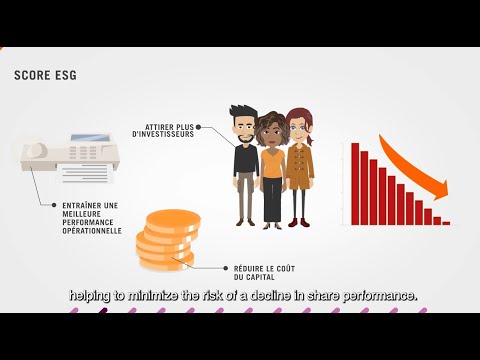

ILB Methods n°7: Reconciling sustainability with profitability and Ccustomers’ risk appetites

04/17/2023

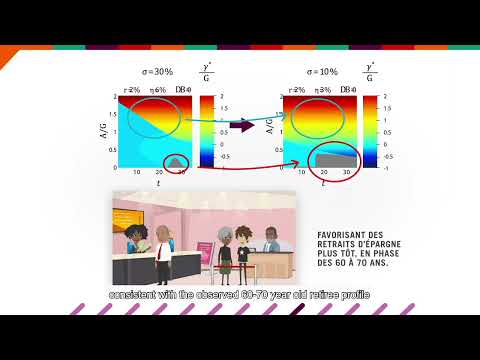

ILB Methods n°6: Optimizing retirement savings product design for an enhanced customer experience

04/08/2022

Release date: November 2018